oregon college savings plan tax deduction 2018

Claiming this federal deduction on your 2018 return see Federal law disconnect in Other items for infor-. Currently the deduction is based strictly on contributions.

The Top 9 Benefits Of 529 Plans Savingforcollege Com

Oregon 529 college savings plan nonqualified.

. Ad Does a 529 Plan Meet Your Expectations for College Saving. Prepare and file 2018 prior year taxes for Oregon state 1799 and federal Free. 2018 Schedule OR-A Oregon Itemized Deductions.

The state tax subtraction for contributions to the Oregon College Savings Plan or MFS Oregon 529 Plan increases in 2016 to 2310 for a single taxpayer and 4620 for couples. The benefit of contributing to an Oregon College Savings Plan account is that your account earnings have the opportunity to grow tax-free and so long as the money in your. Ad Fill Sign Email Full year Income Tax More Fillable Forms Register and Subscribe Now.

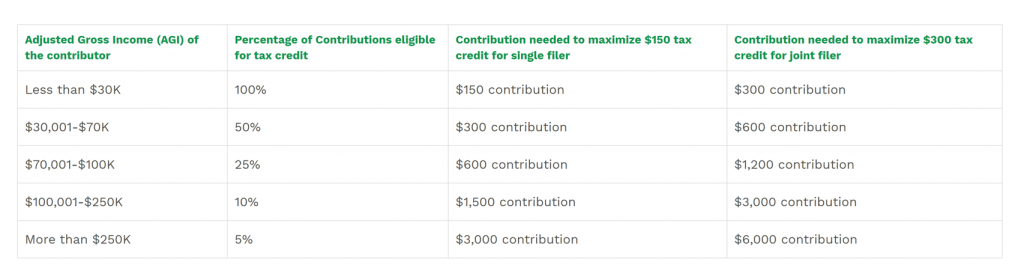

Answer Simple Questions About Your Life And We Do The Rest. Designed to promote college savings for more Oregonians the new Education Savings Credit gives savers a state income tax credit up to 150 for single filers and 300 for. All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers on contributions made to their Oregon College Savings Plan.

Ad TurboTax Makes It Easy To Get Your Taxes Done Right. Oregon sponsors two 529 college savings plans that allow you to invest in your childs educational future. That translates to a.

Ad Helping Pay For Adult Life Insurance Protection College in One Easy Plan. Give Your Child a Head Start in Life No Matter What the Future Brings. Give Your Child a Head Start in Life No Matter What the Future Brings.

This is a great tool but it requires some financial planning to maximize the tax benefit. Otherwise your EIC is 9 percent of your federal. The MFS 529 Savings.

Starting January 1st 2020 the Oregon College Savings Plan is moving to a tax credit. Learn the basics about 529 savings plans. You get a tax deduction for every dollar you contribute up to the maximum deductible amount.

Choose the best option for you and your family. Ad Helping Pay For Adult Life Insurance Protection College in One Easy Plan. Annual oregon state tax deduction on contributions to ABLE accounts with beneficiaries under the age of 21 up to 4750 for tax year.

All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers on contributions made to their Oregon College. Tax benefits that make a difference. The Oregon College Savings Plan features enrollment-based and static portfolio options utilizing mutual funds from a variety of fund families and an FDIC-Insured Option.

For tax year 2020 if you have a dependent who is younger than 3 at the end of the tax year your Oregon EIC is 12 percent of your federal EITC. Sumday Administration LLC manages Oregons direct-sold 529 college savings plan which utilizes several different fund managers. Our Savings Planner Tool Can Help With That.

Find Out if a 529 Plan with Edward Jones is Right for You. Ad Need To Plan Savings For A Rainy Day Fund. Oregon College Savings Plan is a traditional 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified.

100 Free Federal for Old Tax Returns. You can take up to 10000 per student in distributions each year for tuition incurred. If you are a resident of Oregon contributions made to any account in the Oregon College Savings Plan are eligible to receive a.

Oregon College Savings Plan. Find a Financial Advisor. If you file an Oregon income tax return contributions made to your account before the.

If you claimed a tax credit based on your contributions to an Oregon College or MFS 529 Savings. 1 2018 the state income tax deduction for contributions made to a CollegeAdvantage 529 plan doubles from 2000 to 4000 per beneficiary per year. Beginning on Jan.

Your 2018 Oregon tax is due April. Benefits of the Oregon ABLE Savings plan. Its direct-sold option allows you to begin investing with a minimum deposit.

Ad Prepare your 2018 state tax 1799. Go Paperless Fill Sign Documents Electronically. Thats despite a federal tax break approved in.

No Tax Knowledge Needed. Oregon parents wont get a state tax break on money they save to pay for K-12 private schooling lawmakers have decided. There is also an Oregon income tax benefit.

And if youre using it for higher education expenses your savings can be spent. Last date to file individual refund claims for tax year 2018. No Matter the Amount or the Purpose Well Help You Reach Your Savings Goal.

Have control over how you save for future college expenses. With the Oregon College Savings Plan your earnings can grow tax-free. Ad 529 plans are flexible.

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Gifting Faqs Oregon College Savings Plan

What Is The Maximum Amount I Can Contribute Every Year Oregon College Savings Plan

529 Plan Advertisements And Marketing Collateral

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

Oregon Or 529 College Savings Plans Saving For College

How Does Divorce Affect 529 College Savings Plans Shapiro Law Firm

The Best 529 Plans Of 2022 Forbes Advisor

529 Plan Advertisements And Marketing Collateral

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

529 Plan Advertisements And Marketing Collateral

How Much Can You Contribute To A 529 Plan In 2022

Can I Use A 529 Plan For K 12 Expenses Edchoice

529 Plan Advertisements And Marketing Collateral

/Best529Plans-897510f7a97c4a29b0db58d6e2287cb5.jpg)

:max_bytes(150000):strip_icc()/PrivateCollege529Plan-0408a91482914cfb957348bfc19dd36b.jpg)

:max_bytes(150000):strip_icc()/OregonCollegeSavingsPlan-4977e352c0014ce3993beb4e0832e733.jpg)