dallas texas local sales tax rate

Not all Texas cities and counties have a local code. The state sales tax rate in Texas is 625 and local rates can be as high as 2.

Texas Infrastructure Asce S 2021 Infrastructure Report Card

Texas has recent rate changes Thu Jul 01 2021.

. The minimum combined 2022 sales tax rate for Dallas Texas is. Luke Wilson was born in Dallas Texas on September 21 1971. Updated at 1230 pm Feb.

Sales results by month are posted on the Delinquent Tax Sales link at the bottom of this page. Its inheritance tax was repealed in 2015. AUSTIN Texans doubled down in 2019 against having a state income tax voting for a revamped ban in November.

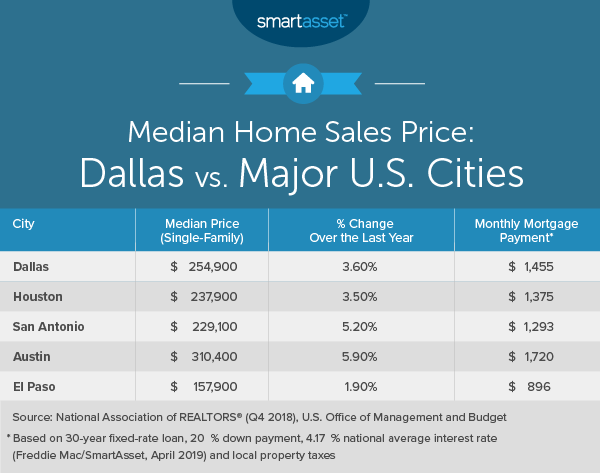

The median property tax in Dallas County Texas is 2827 per year for a home worth the median value of 129700. Dallas Houston and San Antonio all have combined state and local sales tax rates of 825 for example. State of Texas and the largest city in and seat of Dallas County with portions extending into Collin Denton Kaufman and Rockwall counties.

Texas Tax Protest was founded in 2010 with the mission of making the property tax appeal process easier. The Dallas sales tax rate is. Select the Texas city from the list of cities starting with A below to see its current sales tax rate.

With an estimated 2017 population of 1341075 it is the ninth most-populous city in the US. The value is then multiplied by the local tax rate to determine your tax bill. The Texas sales tax rate is currently.

DART was created in 1983 to replace a municipal bus system and funded expansion of the regions transit network through a sales tax levied in member cities. According to Texas REALTORS in the third quarter of 2021 the Median price in the Dallas-Fort Worth-Arlington metro increased by approximately. This rate is made up of the 625 Texas state rate plus the 1 Irving sales tax rate and the Dallas Metropolitan Transit Authority MTA rate of 1.

Local tax rates in Texas range from 0125 to 2 making the sales tax range in Texas 6375 to 825. Cities and counties without a local code do not charge a local sales and use tax. With a 2020 census population of 1304379 it is the ninth most-populous city in the US.

The County sales tax rate is. As a Certified Public Accountant and investor the founder realized that one of the biggest costs and most important aspects of owning Texas property is often overlooked and rarely discussed. There are over 11000 sales tax jurisdictions in the United States with widely varying rates.

Dallas ˈ d æ l ə s is a city in the US. With local taxes the total sales tax rate is between 6250 and 8250. Demand for single-family homes has risen and supply has lagged since the second half of 2020.

Stevie Ray Vaughan was born in Dallas Texas on October 31954. Actor brother of Owen Wilson. Dallas ˈdæləs officially the City of Dallas is a city in the US.

You will pay 625 taxes in Texas for everything you buy except groceries and medication. The gasoline tax is 20 per gallon. The important question surrounds who is responsible for paying for this.

Texas has no income tax and it doesnt tax estates either. 1 of 10 million is still 100k. Dallas County collects on average 218 of a propertys assessed fair market value as property tax.

Dallas County has one of the highest median property taxes in the United States and is ranked 194th of the 3143 counties in order of median property taxes. The Dallas housing market is doing great after recovering from the blows of the pandemic since July of the pandemic year. However the combined rate of local sales and use taxes cannot exceed 2 making the highest possible combined tax rate 825.

Ryan Cabrera was born in Dallas Texas on July 18 1982. TEXAS SALES AND USE TAX RATES January 2022. There are a total of 954 local tax jurisdictions across the state collecting an average local tax of 1647.

And hotels charge 6 of the price of your accommodations. Cause numbers are noted as withdrawn struck off or sold This information will remain available for 45 days following each monthly. And third in Texas after Houston and San Antonio.

With local taxes the total sales tax rate is between 6250 and 8250. When you compare it to Texas 625 sales tax rate tax rates of 0575-1 seem pretty low. Texas also imposes a cigarette tax a gas tax and a hotel tax.

3 2020 to clarify Texas sales tax rules on food. While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied. The average rate Texans can expect to face is about 82.

Texas Sales Tax. Muscian and boyfriend of Ashlee Simpson. The sales tax is 625 at the state level and local taxes can be added on.

Name Local Code Local Rate TotalRate Name Local Code Local Rate TotalRate AustinETravis Gateway Lib Dist Travis Co 6227668 010000 082500 Barclay 067500 AustinMTA 3227999 010000 FallsCo 4073002 005000. Theres no personal property tax except on property used for business purposes. Find your Texas combined state and local tax rate.

Property taxes are based on the homes value assessed by the appraisal district. While those high rates will certainly affect the budgets of retirees there are several helpful exemptions. Combined with the state sales tax the highest sales tax rate in Texas is 825 in the cities of Houston Dallas San Antonio Austin and El Paso and 106 other cities.

State of Texas and the seat of Dallas County with portions extending into Collin Denton Kaufman and Rockwall counties. Cigarettes will set you back 141 per pack. An example of origin-based sales tax rules in effect.

Texas has recent rate changes Thu Jul 01 2021. Dallas Area Rapid Transit DART is a transit agency serving the DallasFort Worth metroplex of TexasIt operates buses light rail commuter rail and high-occupancy vehicle lanes in Dallas and twelve of its suburbs. Located in North Texas the city of Dallas is the.

Name Local Code Local Rate Total Rate. This is the total of state county and city sales tax rates. And the third-largest in Texas after Houston and San Antonio.

The base state sales tax rate in Texas is 625. Some localities add their own tax onto this which can raise the sales tax to as much as 825. Spud Webb was born in Dallas Texas on July 13 1963.

Click here for a larger sales tax map or here for a sales tax table. To make matters worse rates in most major cities reach this limit. Sales taxes are Texas state-level taxes sitting at 625 but local governments can add more sales taxes on top of.

But in context the total costs are pretty significant. Texas sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Select the Texas city from the list of popular cities below to see its current sales tax rate.

Among major cities Tacoma Washington imposes the highest combined state and local sales tax rate at 1030 percent.

Texas A Top 10 State For Raising Kids Creditdonkey Says Houston Business Journal Houston Travel Houston Vacation Houston Skyline

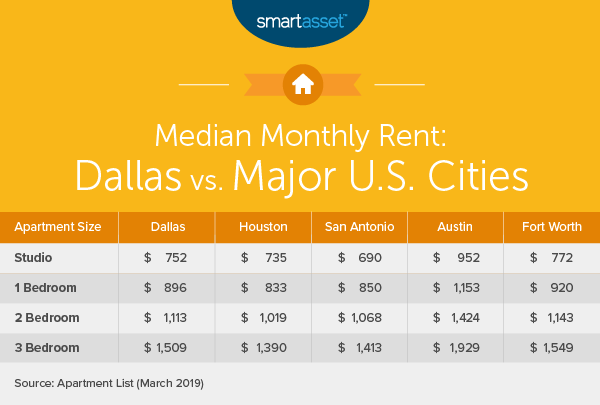

Cost Of Living In Dallas Smartasset

Georgia State Sales Tax Georgia State Visit Georgia Georgia

Cost Of Living In Dallas Smartasset

Cost Of Living In Dallas Smartasset

Downtown Houston Office Buildings By Jeremy Woodhouse Downtown Houston Downtown Houston

South Dakota Sales Tax Rates By City County 2022

Cost Of Living In Dallas Smartasset

When Are Property Taxes Due In Texas Find The Texas Property Tax Due Dates More Tax Ease